A No Spend Challenge is great for the budget, but what is it and how do you start? Get the simple rules and game plan for a successful fiscal fast. Create a meal plan and learn how to regrow your food in water for your no spend challenge!

A few years ago we embarked on a no spend challenge where we spent zero dollars for a whole month. That’s right…zero spending for an entire month!

Benjamin Franklin is the one who quoted, “If you fail to plan, you are planning to fail,” and his advice couldn’t ring truer when you’re looking at 30 days of not spending a dime.

I mean, the thought of no spending for a month alone is daunting… but then to face the challenge head on without any plan in place?! We all know that’s just a disaster waiting to happen.

But how do we plan? Where do we even start?!

From the beginning.

Anytime you tackle a goal, whether big or small, you always start with what you already have and what you already know. So let’s start by clarifying what a no spend challenge is and then get on with the rules.

What is a No Spend Challenge (Fiscal Fast)?

A no spend challenge is a chosen period of time where you stop spending money on anything you don’t need (if you want to buy something extra, it has to come from earning extra money, not your regular personal finances). You cannot use credit cards or your debit card. Overall, it’s a set time frame to curb your spending habits, hopefully learn how to eat simple real food, which can ultimately help you reach your long term financial goals.

What is the Purpose of a No Spend Challenge?

The purpose of a no spend challenge is to take a break from all things money related. When we completed our 30 Days of No Spending challenge a few years ago, we had a new appreciation for what we had. We became MUCH more content with what we already had and focused much less on things we wanted.

We had also met our savings goals and became much more selective when shopping for any item. Frivolous purchases were no longer, and plenty of time and thought went into every small decision we made.

11 Simple Rules for How to Do a No Spend Challenge

1). Figure out why you want to have a fiscal fast

What is your no spend challenge motivation? Are you saving for a vacation? Paying off debt? Do you want to stop living paycheck to paycheck? Do you have long term goals? Simply being clear on your intentions is important for having a successful no spending challenge.

2). No stocking up!

Seriously. No stocking up. Just because you’re not going to be spending money for a month, doesn’t mean you can run to the grocery store and buy two months’ worth of groceries. Shop how you normally shop and work with what you have on hand once the fast begins. You will be surprised how much you have and get new perspective on ‘enough’.

So… what do you do when you run out of food? You’ve got some options:

3). Limit Transportation Costs during a no spend challenge

Ok, tricky one here. Sure, fill your tank up before your fiscal fast begins. However, see if you can make it to the end of the month on just that one tank of gas. For those with commutes and/or those with two cars, see if you can get creative with the gas you have available between the vehicles.

For example, we ended up toggling between our cars during our no spend challenge, depending on which one had more gas, or what the purpose of the trip was.

Ultimately, use common sense. If you need to fill up so you can go to work, fill up. We don’t want you to lose your job.

4). Start Selling your unwanted items

You know that old bicycle in your garage, the extra television in the third bedroom or the laptop you never use anymore since you bought an iPad? Yep, you guessed it, time to go. This is where the fun starts, and where you’ll really start making those hard decisions.

Since you’re not spending money on gas (because you’ve limited yourself to using your car for work and/or personal commitments), you now have a lot more time around the house.

Use all your spare time to sell those spare gadgets on Craigslist, Ebay, or your local sales page. It’s time to purge those items you don’t really use. Most of us have a lot of unnecessary “stuff” lying around the house or in a closet that if it went missing, we probably wouldn’t care. Or even notice. Do yourself a favor and get rid of it!

Which brings me to my next point:

5). Can I buy anything on a no spend challenge (fiscal fast)?

Yes and no. Any money earned from selling those old and dusty items can only be used for items that will sustain you: food and gas. That’s it.

During our first challenge, we made over $100 by selling our old stuff. We could have spent it all on food and continued to eat how we normally ate, but we didn’t. Instead, we limited ourselves to $6 once a week and used it on milk, produce and ice cream (you know, the essentials).

In other words, we forced ourselves to live extremely frugal for the challenge. We pretty much emptied our kitchen cabinets and still did well. However, we did have a weekly CSA box at the time (that was a birthday gift and did not come out of our own pocket).

6). Do I still pay my mortgage during a no spend challenge?

Yes, unless you want to live in a van down by the river. : )

Please don’t be so extreme and skip your mortgage payment, utilities and so forth. Use common sense, and pay “the man” what you need to in order to heat your home and meet your financial obligations. The purpose of this challenge is to live below your means, and be more content with what you have, not ruin your credit and become homeless.

How do I survive a no spend challenge month?

You survive the month by planning ahead! Here are the rules for planning with the following steps…

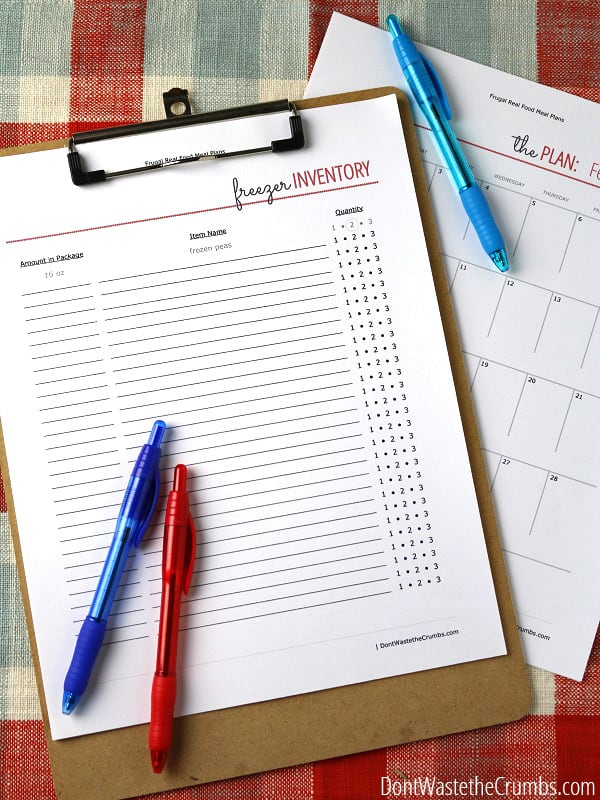

7). Take Inventory and Stock of What You Already Have

Taking inventory of your kitchen is definitely a great start, and I highly recommend doing that, but consider what you normally buy for other areas of the home too.

- toilet paper

- personal hygiene

- school supplies

- clothes

- birthday/anniversary gifts

- home decor/organization tools

- printer ink & paper

Walk around the house, making yourself fully aware of items that you regularly replace and ask yourself a few questions:

- How much do I have right now?

- Will it last me the rest of the month?

- Can I go without it?

- If I have to replace it, how much would I need to make it through the month?

Also see my post on How to Make a Toiletries Budget.

The goal of the challenge isn’t to deprive you of the fun things in life, rather to cultivate true thankfulness and content in the things we already have. Consider making some toiletries with staples you already have on hand. Plus, they’re healthier and safer too!

8). Look Ahead to What’s on Your Calendar

We’re talking doctor appointments, birthday parties, work, school, church… places you have to drive to, field trips to take, events you have to contribute to, or gatherings you’re hosting at home.

It’s best to be fully aware of what your calendar contains, so that you don’t accidentally find yourself in a bind later in the month.

A few questions to consider as you review your family, work and school calendars:

- How many miles do I have to drive this month? Can any of the trips be combined? Eliminated?

- Is it absolutely imperative that we attend this activity? Or can we miss it?

- How many meals are we eating at home?

- Do we have any commitments we have to bring food to?

- How many people will be coming over this month? And for what type of activity?

Think ahead, and be prepared!

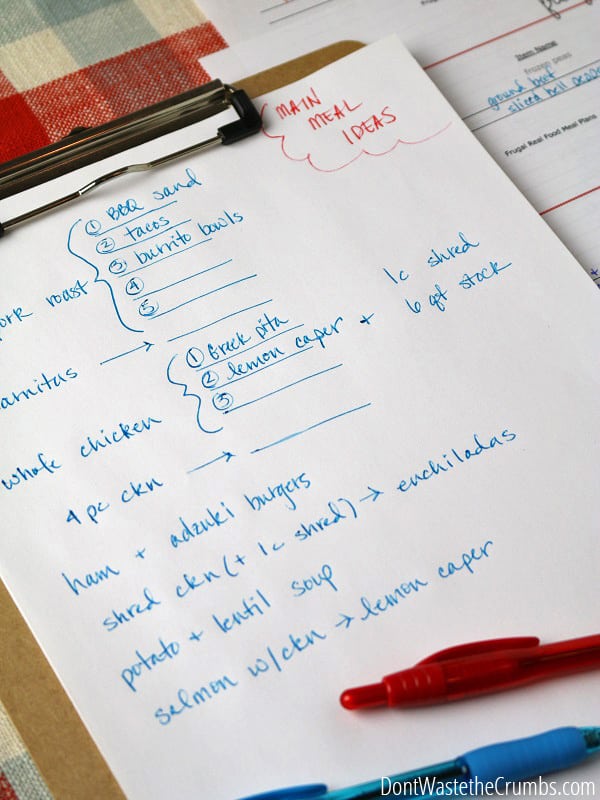

9). Plan ahead with what you already have

If taking inventory was step 7, and looking ahead was step 8, this step is the bridge connecting the two:

- This is where you ‘meal plan,’ and strategically place your meals so you don’t have to eat rice and beans every night for a week.

- This is where you scour frugal recipes to see what you can make with just potatoes and frozen corn. To see what delicious dish can be made with only a bag of frozen vegetables.

- Think about all the places you’re committed to be and see if you have enough gas to get you there. See step 4 for more ideas on this.

- This is where you prioritize your needs, if you’re forced to make a decision between gas in the car or toilet paper.

Check out these helpful posts for more support with meal planning!

- 9 Meal Planning Methods and a Solution for Everyone

- Myths About Meal Planning

- 6 Tips to Help you Stick to a Meal Plan

- How to Meal Plan and Make it Work

10). Fill in your Financial Gaps with Creativity

Consider that you might have to get creative with making ends meet. Remember that you can sell things, work odd jobs or whatever else you can think of to earn extra income above and beyond your normal salary – to help you out this month.

But there are other options too, if we think outside the box. Here are a few ideas:

- Save money by buying just one of something instead of 20 (yes, 20 is the better deal, but 1 costs less and might be all you need).

- Trade your abundance with friends (have a lot of rice but need toiletries?).

- Host gatherings instead of driving to them.

- Shop only where you have gift cards, and let the balance be your spending limit.

- Go to free activities within walking distance, and expand your “walking distance” by a mile or two.

- Rideshare or carpool (consider work, school, kids and church).

- Offer to cook in exchange for rides (for parents and/or kids).

- Make an appetizer buffet for dinner.

- Host gatherings after lunch but before dinner, and serve lemonade and iced tea.

- Host a dessert party instead of dinner and make a few different flavors of popcorn.

- Rent movies from the library.

Here are some money saving tips to help get your creative juices flowing!

- 25 Food Substitutions that Will Save you Money

- 10 Ways to Save Money on Coffee

- 6 Ways the Instant Pot Saves Money

11). Get Your Family and Friends On Board with a No Spend Challenge

When we started our first challenge, it was awkward when our friends (who read the blog) asked us “How is it going? The whole not spending any money thing?”

On their behalf, they were just curious if it was even possible, and why we would want to do that to ourselves. However, they were genuinely interested, and I think that we set a great example for them to want to try it themselves.

By the time we had completed the challenge, our outlook on what we needed versus what we wanted had totally changed.

Our hearts were so content and we no longer desired wasteful, frivolous things. We focused on how we’d already been blessed. And those questions our friends kept asking us? We were thrilled to answer because our perspective had changed so much!

More Money Saving Tips

- How to Save Money on a Pantry Challenge

- 5 Reasons You’re Not Saving Money on Food

- 25 Food Substitutions that Will Save You Money

- Stocking a Real Food Pantry to Save Time and Money

We’re not doing a fiscal fast but this series really helped me as our next paycheck is coming soon and our budget is $255 for that month (including food, household items, cleaning products etc) for two people with IBS and several severe (and many less severe) allergies as well as being vegetarians. This will include a trip away for a week for my partner as well as having company over for a few days and a birthday party. Our usual budget is about $760 but we regularly end up around $900 (to be fair, the minimum a family of 2 should spend for two people – for the lowest income families – is something like $700 according to the government consensus who gives out social benefits etc so we really aren’t splurging that much. We just, and I mean literally, live in one of the most expensive countries in the world when it comes to food. Thankfully food prices are high because paychecks are as well so it tends to balance it all out for most people, though people spend more % of their income on food here than almonst any other western country). Anyways, this was a real help when making a monthly food plan and going through all kitchen inventory. Thank G-d we have enough beans to cover the whole month as that’s one of our main staples that we both need and love. We’ll see how it goes. At least we’re motivated to making it work. Thanks for being a support in our financial journey without even knowing us!

What would you do about unexpected medical expenses or other emergencies? (Such as the furnace quits working, etc)What about monthly bills, insurance, rent, utilities?

Typically during a no-spending challenge, you assume that there won’t be any crazy unexpected emergency. Depending on what it is, it’s up to you if you want to pay for it or not. It’s not necessarily the “law” that this challenge is for, but the heart behind it. If you can go without the furnace working, then great! But regular expenses (i.e. bills, rent, etc.) should definitely be paid. I’m not suggesting getting in financial trouble here!

I like this idea and would love to try it. However, we live in a rural & economically depressed area where selling things via Craigs List, etc just doesn’t work. My husband drives 52 miles to work and back each day. I just don’t see a way around not needing to buy gas. Other than that issue it should be fairly straightforward to achieve this. I may go ahead and do it with the caveat thay buying gas to go back and forth to work in his car is allowed. But it will have to wait at least until March as I have already committed myself to activities that will use up more than 1 tank of gas for Jan & Feb.

I’d love to try this July 2016. Is that too late, also I have 13 year olds birthday to think about. She’s not that into the challenge nor is my six year old. Lol.

Any tips?

It’s never too late to start Gloria! For the kids, tell them up front what you’re doing, what the goal is and that it’s a short-term thing. Put an end date on the calendar and let them help you think outside the box for creative ideas to not spend money. Anytime they complain, gently remind them again of the goal. We found that it took a few times of explaining before the kids caught on to the fact that we weren’t spending money, lol. And I gave them options frequently – like you can have toast for breakfast OR lunch, but you can’t have both because we have other food to eat too (toast might be a bad example, but it works for when you don’t have much of something they really like).

Hi Celeste! I would definitely categorize business supplies as a “need” – but try to only buy what you absolutely have to. Even though you’re not joining us this time, you can still cut costs on your trip by packing food and limiting your driving when possible. Good luck and have a safe trip!

Love your whole site! It’s a treasure trove.

I found you last night when looking for a facial wash and was drawn in. I have 100 dollars a month to spend on groceries and household items and I am very frugal. I am mostly vegan I don’t allow meat into my house for phobic germ reasons…haha, and don’t like dairy (except cheese) which helps keep my costs down.

What I was wondering about (for this challenge) what you do about your ‘fresh’ veg and fruit? I went shopping today before reading about the challenge and spent 60$ stocking up on all the items I would need to make my meals for the month thinking I would just run to the store weekly for fresh fruit and veg salad fixins, but now I want to try the no spending challenge but what do you do about fresh stuff?

I immediately felt like a pirate when you said “treasure trove!” Thank you!!

Fresh veggies and fruit: We had a pretty good supply before we started the challenge, so we had a little bit of time before desperation kicked in. In order to get fresh fruit and veggies though, the rule is to sell something in the house (that we don’t use anymore) to fund basic necessities.

Welcome to Crumbs Plastraa, hope to see you around!

Hello Tiffany. Just wanted to say I admire your commitment and resolve. I have been following you for a while but never commented. I have learned many things from you that helped me greatly with our budget and just wanted to say thank you. I Would love to try something like this, but my husband would be really hard to convince. Maybe one day. I will be following your journey and taking notes on the things I can implement. Cheering everyone on!

I have a suggestion for Stacey and her milk dilemma. I had a similar situation when we started our switch to an organic whole foods diet with my girls. They used to drink 4 gallons a week of 2% milk. Could not afford to continue consuming the same amount with organic milk, so I started buying whole milk and diluting it with water . 2 cups of milk to 1 cup of water is very close in consistency to 2% ( 1 :1 ratio for skim milk) . They never noticed the difference and neither did their friends! Hope that helps.

Gwen, thank you for such a thoughtful comment! You made my day! I’m glad that Crumbs has been a blessing to you and your family!

I am behind here, so I definitely wouldn’t start this still at least tomorrow. Need to inventory, but the meal plan is actually in place for the next two months ’cause I made it my Ultimate Goal for the year to get them planned. Plus I wanted to see how few times I could run to the store.

My only problem with this sort of challenge is that I have two heavy milk drinkers (both teenage boys) and storing 24 gallons of milk in the freezer or fridge is just not possible. (Well, possible, but not feasible.) So regardless there would be either a weekly or biweekly milk run. I’ve thought about trying to stretch their supply with dry milk, but I’m a little worried how that would go over. Actually I did just discuss it with the 15 year old and he’s game to try out a couple things but he’s the easy-to-please kid anyway.

I’ll have to discuss this with the Man/lings and see if they’re up to the challenge!

I love that you’ve challenged yourself NOT to run to the store, lol!

We talked about the milk issue too here, and decided to make non-dairy alternatives (coconut milk mostly) for all cooking purposes, and then that will become our creamer too when we run out. Maybe cutting it back just a little bit with alternatives could help you stretch the milk?

I’m all ready for this… Then realized last night that I have about 1/8th of a tubes of toothpaste left! Then I thought hard for alternatives. … And discovered that, besides using baking soda, I have several sample tubes of toothpaste I can use up. They are probably in need of being used anyway. So, first crisis averted!

Way to go Sharon! Good thinking on your toes! 😉

Aw, c’mon Amy! Just try two days. It’s not so bad once you start! 😉

where can I find the downloads for the printable’s? I applaud you on your efforts. I was going to try, but already, yes already, ran in to a problem. 🙁 I will start over in March. I was not very prepared. 🙂

thanks!

Hi Bobbi! There should be a big grey box in the center of the page with a blue “download” button. Enter your information, click the button and it’ll be emailed to you!

ok, found it. How can I get the inventory sheets too? 🙂 Thanks

sorry, these are the budgeting worksheets. 🙂

Bobbi! I’m so sorry! That’s fixed now. Thank you for telling me!!!

(running away embarrassed, lol)

no, no, no, it’s ok! 🙂 I am glad it got fixed, lolol