Learn ways to cut your budget and monthly expenses! Save money, pay off debt, gain your financial freedom, and spend more time with the family!

When we were newlyweds, we were faced with taking a hard look at our finances. We had a baby on the way and had to cut our monthly expenses. We were ruthless, leaving no bill or expense unturned. In the end, we found ways to reduce our monthly expenses, cut our budget in half, AND create an emergency fund.

Here are some practical & simple tips that helped us save money, pay off our debt, and gain our financial freedom!

HOW WE CUT OUR BUDGET & EXPENSES IN HALF

1.Take a hard look at your monthly expenses.

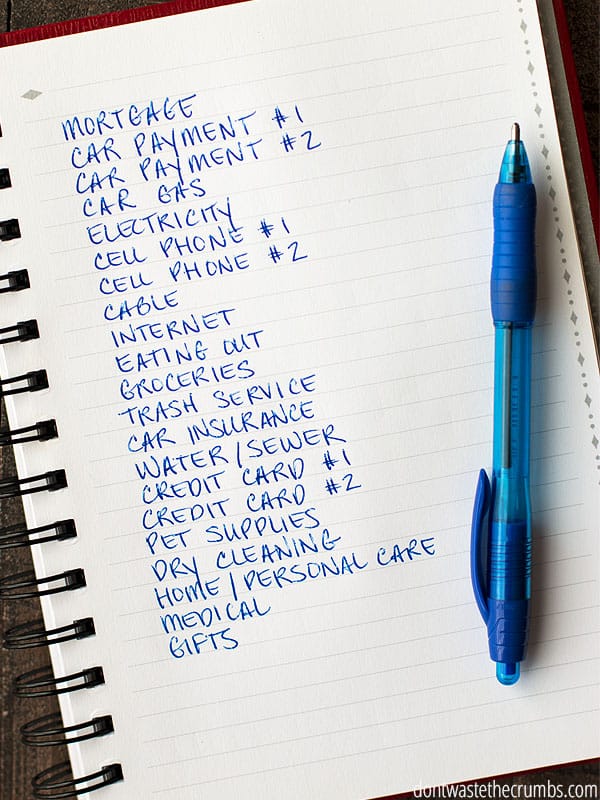

First, see where your money is going. If you don’t know what you are spending your money on, you won’t know where to cut expenses.

Leave no stone unturned, no purchase unaccounted for.

- Print off bank statements

- Credit card statements

- Dig up receipts

- Old bills

- Open the checkbook you may rarely use –

- Whatever you can get your hands on.

Use it all to help you write down every single thing you’re responsible for every month.

Just being aware of what your current monthly expenses are is a HUGE step, so you can cut the budget. All of these line items are essentially now items in your household budget.

2. Reduce the obvious expenses

Once you know where your money is going, it’s time to start reducing– starting with the monthly expenses that are not necessary. You may even be unaware of some of these expenses.

For us, some of these monthly expenses were in areas we grossly overspent, like:

- Dining out

- Groceries

You can still have weekly date nights, they just may look a bit different than before (we would split fajitas, savor free chips and salsa, and share a cup of coffee together).

Ideas on how you can cut budget:

- Combine cell phone bills, or change carriers altogether, like we did. $35 a month for two cell phones with unlimited talk and text? Yes, please, and thank you!

- Snip the cable– We knew that cable wasn’t necessary, but it was a small token of entertainment that we enjoyed. We switched to satellite service AND reduced the plan to the bare minimum. This saved us another $50 each month. (We ended up canceling satellite service altogether about a year later.) Same goes for all those streaming services.

- Old memberships that you no longer need or use? Have a gym membership? Work out at home and save!

- House cleaning or dry cleaning for anything other than what’s absolutely a must. Consider making your own cleaning products to save money where practical for your lifestyle.

- Clothing/Gifts/”Miscellaneous” Items

- Shop around for a lower house and/or car insurance rate

- Look for coupons, rebates, discounts, and sales

- Free entertainment– This is where the library comes in! They have an endless amount of books and movies and music, etc! National parks have trails, and local playgrounds are always a free way to spend time!

- Check for lower internet service rates

- Shop once a month and plan your meals. This helped us when we initially created our budget.

Review your monthly expenses line by line and ask whether or not it’s needed, and cut it if the answer is no!

3. Reduce Even More

You’ve now made some serious progress at this point. If you find that you need to cut your monthly expenses even more, then you need to get creative!

- Trade in cars. It might sound counterintuitive to do this, but it meant lower monthly payments – which was the short term goal. Just by trading in our two cars, we saved $380 each month. Another reason for trading our cars though was to choose models that were more efficient with gas. This would save at least $50.

- Smaller trash cans. Since we weren’t making that much trash with just the two of us, I called the waste management company and asked if we could have a smaller trash can. I learned that not only did the smaller trash cans cost less each month, but that a recycle bin was free. This meant we could increase our recycling each month AND lower our trash. This saved us $20!

HERE ARE A FEW OTHER IDEAS THAT MIGHT HELP YOU THINK OF CREATIVE WAYS TO SAVE MONEY:

- Once you save enough in an emergency fund, increase the deductible of car insurance to lower the premium.

- Contact your energy provider and see if they have plans that allow you to pay a bill each month that’s equal to the average bill over the past year. This didn’t lower the bill, but it helped to make it consistent each month.

- Although controversial for many (and a very hard decision for us to make), we found a new loving home for one of our pets. He was a puppy (8 weeks old) destined to be a very big dog, and the money needed every month to care for him just wasn’t there. We found him a new home with a family who lived on a farm – who happened to be a co-worker!

- In the end, all of these changes helped us reach our goal. We cut our monthly expenses by 50% and we were able to live off of just my husband’s income!

FAQS

What are basic living expenses?

The basic living expenses are food, water, housing, transportation, health care, and child care.

Where to cut monthly expenses?

You need to start off by taking a look at everything you’ve spent and see what is necessary and what isn’t. Whatever isn’t necessary, you cut! Cook at home, stretch meals, and save, save, save! Check out my 100+ ways on how to save money also for more tips.

How to plan for monthly expenses?

It’s best to write everything out. That way everything is in front of you with all of the numbers that are recurring, and you can see what you can reduce.

THE BIGGEST HURDLE TO REDUCING MONTHLY EXPENSES

It’s important to realize that the biggest hurdle we had to overcome wasn’t number-related. It was our mindset.

- We thought we deserved nice things because we made nice money. But we didn’t really own any of it and felt chained to the bills that came in every month.

- Once we wrapped our heads around the bigger goal (including our desire to buy a house in cash), and got over our egos, cutting our monthly expenses and living with the aftermath from that became easier.

- In the end, our sacrifice was worth it. In 2 1/2 years, we paid off our debt and saved enough for a small emergency fund! You can too!

More Ways to Cut Budget

- How to Stick to Your Grocery Budget

- 7 Simple Ways to Afford Real Food on a Budget

- How to Make a Frugal Grocery Budget

- How to Save Money with a Pantry Challenge

Thank you for this insightful information. Our problem is that we are retired now and have gone from a 2 income family to a fixed income. I tried working from home for a while, but due to health reasons I have had to stop that, what to do. I began to look at our outgo and discovered that there were a lot of things that I could do to tighten the belt, so to speak. We ate out a lot, we stopped that and even though it was mostly fast foods, it still mounted up. Now we reserve the dining out for very special occasions. I have no problem using the food bank to supplement our pantry and this has helped a great deal. I looked at our mortgage and found that with an appraisal, I could drop the PMI saving about $175.00 on our mortgage. I am sure that as I keep digging I will find more ways to save.

Love this. Especially the dog part. Thank you for calling it out for what it is, a first world luxury. The pet industry is making bank off people who are so damn convinced you cannot live without a pet.

My households 2nd largest expense is insurance – Health, Car and Home. Got rid of life insurance after my term policy expired. All together paying over 10K a year for insurance. My annual home insurance alone is more than my annual electric bill. There are places in the country where home insurance is more expensive than the combined cost of the electric and gas bills. I have always looked as insurance as a way to protect a vital asset from large economic loss. As a result, I dont want to pay to cover (insure) smaller potential accidents or events. For example, I have a 5K deductible on my home. I also dont like insuring for extremely unlikely events like getting sued. In my 30 years of owning a home I have never been sued. Why should i pay to have $500,000 worth of liability coverage. No pool, no dog and no unlicensed/uninsured contractors in the home. My mailbox is on the street so not even the mail-person can sue me. Be responsible and you wont find the need to pay for something you will never ever use. Wanted to eliminate , but my insurer wont let me lower below 100K. My point is read up on insurance and understand what you want to protect. Is it worth paying $500 a year to cover a car only worth $5000? If your are a one income household or retired couple do you really need two cars?. On those occasions you do would it be cheaper for you to rent a car. Remember to fully cover a second car could easily cost $1,000 to $1,500 a year. Lastly, for many years when I was single the only health insurance I had was a indemnity/hospital medical plan. I was covered only if I went to the hospital period. For doctors visits and prescriptions used a discount card. Look at what fits your needs not your wants. Good luck.

Insurance is a huge expense to account for in your budget – but also a really important one. Many of us have these bills on autopay, so it’s an out-of-sight/out-of-mind bill that just keeps increasing. I finally looked at my car insurance (Geico) bill payments over the last 3 years, and I found that each year my bill would go up a bit more. But I never even realized it 🙁 I finally took a good look at my policy, and like you, I reviewed my coverage and decided on what I really needed. I was paying for rental car insurance – and I had no need for this! Although I didn’t end up saving much, it was an eye-opener on how important it is to look at where your money is going.

Evaluate what is most important to you and most cost effective and is most important to you!

It is really great that this works for you, but I agree that you should have some type of home insurance cause God forbid someone falls on your property or a guest gets hurts in your home they will sue you no matter if they are family or a good friend you want to be covered.

Thanks for the great tips. What you said about changing mindsets is key. And I love that you gave up material things to stay with your baby — time is much more valuable to money, I realize this the more it goes on!

♥

Loved the advice until it mentioned getting rid of a pet. I almost fell out of my chair literally. I’m super disappointed your telling people this should be an option.

Hi Jennifer – when we had the choice to either feed our family or feed the dog, we chose the family and found the dog a new home. Sometimes you have to make hard decisions.

So agree with your comment, gee how much do kids eat that you cannot afford to feed your per?

I am sure everyone can understand that bills pile up and it is not about how much they eat, it is the story of the last straw to break the camels back. It is important to understand that a mother and father have to protect their children above all, even if others they love have to leave their life for this to happen.

Thanks for the excellent article. Everyone can decide to stay home with their young children if they plan it properly. It means not buying a house that is too expensive and not buying other things unnecessarily. In other words it means living within your means. Living a simple life is by far the happiest one. And giving up a pet that you cannot afford is very sensible. Pets are animals, not humans.

I can’t help thinking it sends a bad message to the kids – when someone is no longer convenient to have around, you can just get rid of them.

It got me when you mentioned cutting down the expenses that I know I do not need in order to save money as some of the unneeded areas are actually where the person grossly overspend. I have to agree with this because I usually spend a lot on watching a movie. If that is the case, then I might stop watching movies permanently. After all, I need to save the money for the phone plans– that is more important for me.

Great article!

Here’s some of the things that we’ve done:

1) Kept the house at a hotter temperature in summer and cooler temperature in winter

2) Used Cricket wireless (and shared a group plan with our friends) along with hand me down smartphones. We also use our Target debit card to buy refill cards, which saves 5% per month on the bill.

We have unlimited minutes, unlimited texts, and 5 GB of data. We pay $38 per month for service our two phones.

3) No cable or trash service. We don’t have a TV. Someone recently tried to sell me cable service and I got a laugh out of his reaction when he realized that we don’t have a TV.

For trash, we recycle and compost heavily. That leaves only a small amount of actual trash, which I haul periodically to the dump for $1-2 per trip. (no more than once a month and sometimes less) I wait until I’ve filled up a 32 gallon can and it takes us at least a month to do that. That saves roughly 90% over paying for curbside trash pick up. There’s not much convenience loss, considering that I would recycle anyway and have to haul the recyclables at some point. I do the trash dump trip the same day as I haul recyclables.

4) We shower as needed (not necessarily every day, especially in winter) and try to keep showers shorter and reuse bath water for younger kids if possible.

5) We try to avoid disposable items wherever possible. Every disposable item creates a recurring expense since they need to be replaced. I’ve found a lot of awesome alternatives to disposables. For example, kitchen towels, rags, and cloth napkins instead of paper products, glass and stainless steel straws instead of plastic, stainless steel plates instead of paper plates, cloth sandwich bags, reusable lunch bags, glass storage containers, cloth feminine pads and menstrual cup, etc.

6) We pay our car insurance in full, because they discount it. We set aside a set amount each month, so that we always have the money when the bill comes due.

You all seem to be able to act very efferently, it’s hard to do, but I commend you on how well you do at conserving in most of these areas.