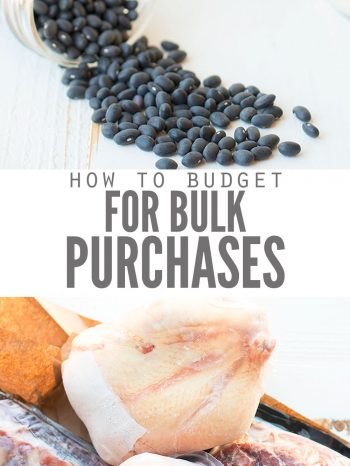

Knowing how to budget for a bulk purchase means you can save money! Whether it’s from a wholesale store or a farm, it’s worth it to budget for bulk items!

We all know that buying in bulk saves you money, and I’ve shared the best foods to buy in bulk to help you stock your pantry with plenty of healthy options.

And I’ve shared how batch cooking can save you money AND time.

But what about the BUDGET part?

Buying in bulk means needing money in bulk. And when you’re on a tight budget, it’s not often that you have a lot of money at one time!

So let’s break this apart and I’ll give you a few options for knowing how to budget for bulk purchases. Then you can pick the one that works best for you!

How to Budget for Bulk Purchases

One of the most frequently asked questions I get in my course Grocery Budget Bootcamp is,“How do you budget for a bulk purchase?”

- Students ask at the beginning, when we’re talking about how to create a grocery budget.

- They ask again when we talk about stockpiling and buying in bulk.

- And they ask again when we discuss reinvesting the money they’ve saved into higher quality meat.

Similar to how a grocery budget will look different for every family, how you budget for a bulk purchase will look different too. Let’s talk about four ways you can make affording bulk purchases work for you.

Psst!! Enrollment for my course Grocery Budget Bootcamp is open!

Thousands of students have enrolled to learn the EXACT SAME system I use to feed my family of four real food for just $350/month. Collectively, they’ve saved over $7.5 MILLION dollars. Isn’t that amazing?!

Go HERE to see what how other people have been transformed!

What’s Considered a Bulk Purchase When You’re on a Budget?

A bulk purchase is anytime you buy enough of something to last a few months. I know there’s some ambiguity in that definition, and that’s because it varies slightly from family to family.

- For a family of two who buys just one small jar of coconut oil every 2-3 months, buying four jars to last a year would be considered a bulk purchase.

- For a family of four who buys two 5lb bags of flour each month, buying 25 lbs of whole grain einkorn berries to last 2-3 months would be considered a bulk purchase.

- For a family of eight who buys six whole chickens a month, buying 30 whole chickens at one time to last five months would be considered a bulk purchase.

These are just made-up examples of course, but you can see how a bulk purchase will look different for each family.

Usually, bulk purchases cover a large amount of time, like six months or more. But for you, buying in bulk might be shopping for two weeks worth of an item instead of one.

There’s no right or wrong way to approach it, and I’m hesitant to even say “a few months,” so just do what’s best for your family.

What Types of Bulk Purchases Should You Budget For?

A lot of people assume that when you’re looking to budget for a bulk purchase, you’re automatically talking about buying a cow.

Many people ARE trying to buy a cow, but that’s not ALL you can buy in bulk. Off the top of my head, here are some of the things you’d want to consider buying in bulk:

- whole grains

- a CSA subscription

- several pastured chickens

- a part of or a whole pig/hog

- whole fish

- dried beans

- canned goods

- high quality oils (like extra virgin olive oil or coconut oil)

- whole spices

- and of course, a part of or a whole cow

This isn’t an exhaustive list by any means, and you want to make sure that whatever bulk purchases you budget for are foods in their WHOLE form so that they don’t go bad.

For example, it’s better to buy whole grains to mill yourself, rather than milled flour, because milled flour will go rancid over time.

Also, make sure you STORE your bulk purchase foods appropriately so you don’t waste the money you’ve intentionally budgeted for them!

When You’re on a Budget, Where Should You Shop for Bulk Purchases?

Anywhere!

Your bulk purchases aren’t limited to a farm or a warehouse store. As long as you’re finding the rock bottom price on the things you’re buying in bulk, WHERE you buy them from doesn’t matter!

5 Ways to Budget for Bulk Purchases

- Pull the money directly out of your grocery budget

- Borrow from your grocery budget and pay yourself back each month.

- Pull money out of grocery budget beforehand and set it aside so that you are slowly accumulating savings.

- Save up and set money aside from other sources

- Pay for it up front from a different budget account.

1. Pull the money out of your grocery budget, when you need it.

The first method to being able to budget for bulk purchases is to simply pull the money out of the grocery budget when you’re ready to make the purchase.

For example, if your monthly grocery budget is $500 and you want to spend $200 to buy a quarter of a cow, you’d pull it out of the $500 and then have just $300 left for the rest of the month.

- Pros: You don’t need to plan for it in advance.

- Cons: You’re losing a large chunk of your monthly budget.

This method does make for less money to be available for the rest of the month, but there are ways to get around this:

- Make “rice and beans” meals for a week.

Let me start by saying this: “rice and bean meals” does not literally mean rice and beans every night (although my family LOVES our rice and beans dinner you can find HERE!).

I’m more so talking about meals that are plain, simple and cheap. Meals like simple spaghetti, grilled cheese on homemade bread that costs just 25¢ per loaf. Your goal is to spend just $1-2 for the entire meal. Over the course of a week, you’re spending roughly $15 on groceries rather than upwards of $100+.

- Have a pantry challenge.

A pantry challenge is when you set aside a certain number of days when you DON’T go grocery shopping. This can be fun, and it will certainly save you a lot of money!

We did this once and ended up going 33 days without spending any money. Imagine having your ENTIRE grocery budget available for you, to spend on whatever you want!

- Skipping a fast food meal or two cups of coffee.

If you have a budget set aside for treats like eating out or specialty coffee, skip those and use it for buying in bulk instead!

2. Borrow from your grocery budget and pay yourself back each month.

This second method to budgeting for a bulk purchase is to “borrow” from your grocery budget now, and intentionally pay yourself back from the grocery budget for a certain number of months.

For example, if your monthly grocery budget is $500 and you want to spend $400 on a CSA for eight months, I would “borrow” $400 from my grocery budget now and reduce my grocery budget by $50 for the next eight months to pay myself back.

You could adjust the terms of this too, if you want, and reduce your budget by $100 each month to pay yourself back quicker.

- Pros: You don’t have to borrow from another pot of money

- Cons: This requires that you already have the money available to spend, and it means you have less money to spend for the rest of the month.

It might not be a big deal to have less money to spend the rest of the month with this method, depending on what you’re buying in bulk. I used a CSA subscription as an example, which means I’m not having to buy much produce for the next several months, if any at all.

So having my budget lower, may not even have an impact. It all depends on what you’re buying in bulk.

3. Pull the money out of your grocery budget, beforehand.

This method is similar to method #2, except you’re pulling the money out of your grocery budget BEFORE the purchase, instead of AFTER the purchase.

For example, let’s say you buy 24 chickens every six months. You know to plan for that bulk purchase twice a year, so each month, you set aside $40 from your grocery budget to go towards that purchase.

- Pros: You don’t have to borrow from another pot of money, you don’t need to pay yourself back.

- Cons: It means having less money to spend for the rest of the month.

Similar to method #2, it might be a big deal to have less money to spend the rest of the month. After all, once you make the purchase of those chickens, you don’t need to buy chicken each month!

However, this would require some sacrifices in order to make that very first purchase. You can use the “rice and beans” meals or the pantry challenge or the skip eating out ideas mentioned above, or you can perhaps lower the amount you’re taking from the budget and spend a longer time saving up front.

4. Pull the money out of a different pot of money each month.

This method doesn’t effect your grocery budget, because you’re pulling money from a different source entirely.

For example, let’s say you have a “fun money” account that you use when you want a fancy coffee or to go to a movie or when you want a new pair of shoes. If you don’t use the entire pot, or perhaps not use the pot of money at all, you can use this towards buying a bulk purchase.

- Pros: It doesn’t effect your grocery budget.

- Cons: This effects your household budget, and may have a domino effect of consequences. Also, the amount you save is unpredictable.

I really like this method personally, because it maximizes the use of money you had already set aside to spend. It also “rewards” you for working hard and practicing restraint in terms of NOT spending all the money in that account.

However, if you’re only saving the scraps leftover from that account, it may take a long time to reach your savings goal.

You can be creative with this method too. After my second child was born, I picked up a part-time job teaching college. My husband and I dedicated all of my paychecks towards savings. You could do something along the same lines!

Remember, it doesn’t have to be the WHOLE paycheck. It could be just one paycheck, or even just part of one. But rather, it’s the idea of “extra” money coming in that you don’t NEED to meet your monthly needs, and putting that aside instead of spending it on “wants.”

5. Pull the money out of a different pot of money, at the time of purchase.

This last method is similar to method #4, but instead of pulling it out of a different pot of money each month, you pull it out of the household budget the month you make the purchase.

This may mean pulling it from what you would ordinarily put into the savings account, or what you would normally set aside towards a new car.

- Pros: It doesn’t effect your grocery budget, and there’s no requirement to pay yourself back.

- Cons: It reduces the balance on whatever pot of money you pulled from.

I have mixed feelings about this method, because I really don’t like the idea of NOT putting money into the accounts you’ve already deemed worth saving for. At the same time, I do like the idea of paying for the bulk purchase up front without having to worry about paying yourself back.

Tell Your Family When You Budget for a Bulk Purchase

When you buy in bulk, the funds to pay for it has to come from somewhere. Because of this, it’s wise to talk to your spouse or significant other to come to an agreement about where the money should come from, and how much it should be.

Also remember that depending on the method you pick, it might effect your whole family. The way you shop may look different, which means meals might look different.

If you jump in with two feet and think, “I’m going to cut back on shopping and save all of this money!” and it means that your family doesn’t get to eat things that they are used to eating, you are pretty much going to have World War III in your kitchen every day!

I don’t recommend making decisions on bulk purchases without your household on board. Definitely talk it out!

Need more saving tips? We talk about this in-depth in my course Grocery Budget Bootcamp (enrollment is currently closed, but you can join my FREE 5-day Crush Inflation Challenge and start saving money on groceries tomorrow!)

These tips help so much. Thanks!

Thanks for the tip of pulling money from different sources of budgets each month. Our company loves throwing holiday parties, and food always seems to be the greatest expense. We will be sure to budget accordingly for the upcoming year’s parties. We will look for food suppliers that sell in bulk so that we can save some extra money.

Hi Mats!

You are very welcome. Glad it helped. 🙂

I used an refund check to start the process and then since I had the bulk, reduced my monthly budget by $50 and put the 50 in a separate account to fun further bulk purchases. Since the money was “found money” to start with no one noticed.

That’s a great idea Jennifer!

This is a good idea and I’ve done something similar. The goal would be to only have to do this once – or once per big item. After that reduce the grocery budget the average amount for that item going forward. My grocery and paper product shopping list kind of runs like a rotation of bulk items (for the items that are better bought that way).

I try to space out my bulk purchases so that I’m not buying everything in bulk at once. Seafood was at a good price during lent so I bought a lot. But then I didn’t buy a ham. Next month maybe I’ll buy a couple hams but not any seafood. I buy paper products in bulk – I’m trying to get to where this month I’ll buy 12 boxes of tissues, next month a huge package of paper towels, the next a huge package of toilet paper, but never all three at once. In January I started taking $10 out of my grocery budget each month and setting it aside for the vegetable garden. That’s covered the cost of dirt/manure, seeds, etc. Hopefully my garden will pay be back in money saved :).