These grocery saving tips are timeless & absolutely fail-proof. Plus they work no matter where you live or how many people are in your family. To learn more about saving on your grocery budget, join the waitlist for my foundational course Grocery Budget Bootcamp!

I’ve been sharing how we save money on food for several years now on this blog, but all of these ideas were put to the test when my family moved across the country.

I was in a new state with new stores and my $330/month grocery budget was out of control.

That’s when I decided to buckle down and focus on implementing the grocery saving tips I knew worked! After just one month of using these tips, my grocery budget was back in line.

The three grocery saving tips I focused on are a lot like these ways to reduce grocery spending. They’re timeless ideas, and work regardless of where you live, how many people are in your family or how big your grocery budget is.

It’s funny how sometimes the most basic ideas are the ones that work the best!

Fail-proof Grocery Saving Tips that Work Every Time

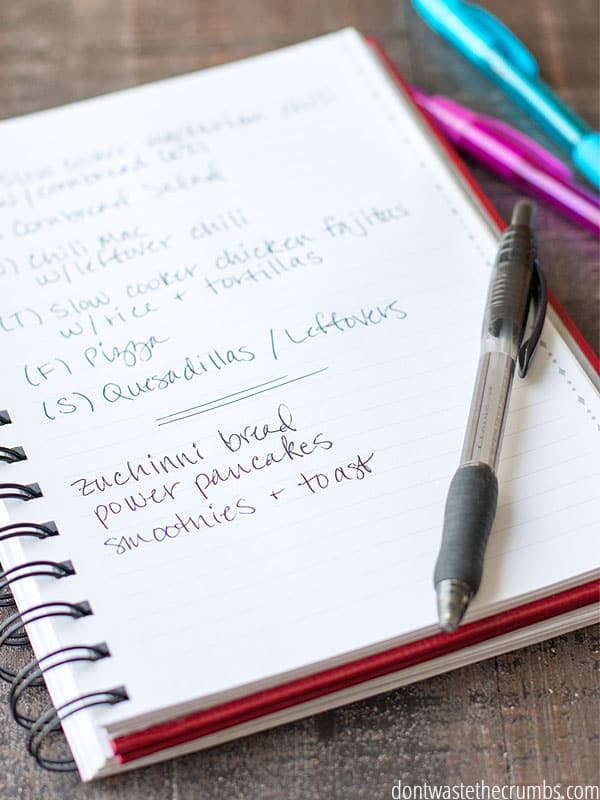

1. Make a Meal Plan

Ah yes, the dreaded meal plan. For people who hate to plan or think ahead or be told what to do, “meal plan” is a curse word.

But let me share this: whether you like it or not, meal planning is one of the grocery saving tips that work.

When people confess why their budget went out of whack, they usually offer things like:

- we had plans after school/work and it’s faster to get drive through.

- it was a long day/night and I didn’t want to cook when I got home.

- it’s overwhelming to look at the fridge and not know what to make with the food I have.

- my family doesn’t like what I cook so we end up getting take out.

Friends, the beauty of making a meal plan (and always having grocery shopping lists) is that you can take all these things into account and plan for them!

Short on time? Be proactive and purposely plan to have an easy dinner that night. Things like pasta with pesto sauce, grilled sandwiches and salads are quick and easy.

Wiped by Wednesday? Plan for your exhaustion and make it leftover night! Pull everything out, set up a buffet and let the family serve themselves. If pickings are slim, make it a top-your-own-oatmeal bar or just serve peanut butter and jelly sandwiches with fruit. Take a break from fancy and recharge for the rest of the week.

Freaked out by the fridge? Don’t look at the fridge – look at your meal plan. Focus on what you planned for the day and one item at a time, pull out what you need. Don’t worry about everything else and just cook dinner.

Picky eaters? Ask them what they like for dinner and plan some of those meals. Let the kids help in the kitchen and serve the men meat and potatoes now and then. A little bit of giving on your end means a happier family on the night they didn’t get to pick what was for dinner.

2. Shop in Bulk

There are rumors that the classic grocery shopping tip of buying in bulk doesn’t save you money. Also that shopping at discount stores like ALDI and buying just what you need versus buying in bulk at stores like Costco or Sam’s saves money in the long run.

Folks, this is simply not true!

Just a couple of months ago I ran a test to see who was cheaper, Costco or ALDI for the items I buy most often. Hands down, Costco had more items for less than ALDI!

Now you might not have a Costco in your area, or think that the cost of a Costco membership isn’t a great deal, or worth it (although it is, by the way). Maybe shopping at BJ’s or Sam’s Club or even shopping online at Amazon would be better for you.

Above all, the point remains the same: you save money when you buy in bulk.

Those who disagree will say that buying in bulk means spending more money by buying things you don’t need – and then subsequently wasting food. However, this is when you have to use discretion and only buy things in bulk that YOUR family will use most.

- If you won’t eat 4 pounds of spinach in a couple of weeks, then don’t buy it.

- If you don’t bake bread every week, then 50 lbs of flour probably won’t do you any good. (Also, if you’re going to buy flour and other grains in bulk, make sure to store them properly to avoid having your food spoiled by pests!)

The point is to determine what you DO eat a lot of first.

- The next step is to start paying attention to where you can buy it at a rock bottom price.

- Lastly, at the start of the month, buy as much as you need for the whole month at that incredibly low rock bottom price and don’t buy it again for the rest of the month.

These classic grocery saving tips get you the best deal up front and eliminate the need to shop for the item later in the month (and usually shopping less means saving more).

3. Shop the Weekly Circular

Stores base their weekly sales on three things:

- Produce that is in season (like watermelon, corn or squash)

- Events going on around the country (like ham before Easter or turkey before Thanksgiving)

- Their own 6-week sale cycle (for things like chicken breasts, pork roasts or peanut butter)

Items that fall in the first two categories won’t change much between local grocery stores. As a result, Whether you shop at Kroger or Albertsons, it’s still summer (or autumn/winter/spring) and it’s still the start of the school year (or it’s Labor Day/Christmas/St. Patrick’s Day).

The only difference you’ll find from store to store are the specific varieties of the items (like yellow squash versus zucchini) and the sale price.

As for items that fall into the third category, you can usually switch up your meal plan based on what’s available. For instance, if you planned for chicken fajitas but pork is on sale, how about making carnitas instead?

Side dishes and vegetables can easily be tailored to what’s on sale too, and by doing this faithfully each week, you could be saving a lot of money every month!

$50 Weekly Meal Plan

Sign up to get instant access to my $50 Weekly Meal Plan, complete with recipes and shopping list!I’ve been implementing these three grocery saving tips faithfully since moving to Georgia as a result they have helped me meet my grocery budget every month. See for yourself! I share what we spend on food every month and you can go back through all the grocery accountability posts I’ve published.

Need more saving tips? We talk about this in-depth in my course Grocery Budget Bootcamp (enrollment is currently closed, but you can join my FREE 5-day Crush Inflation Challenge and start saving money on groceries tomorrow!)

More Grocery Saving Tips

- Fail-Proof Grocery Saving Tips That Work Every Time

- How to Stick to Your Grocery Budget

- 5 Ways to Reduce Grocery Spending

- How to Save Money with Grocery Delivery

- Walmart Grocery Pickup: My Personal Experience and Honest Review

During the Covid lockdown I couldn’t get pork chops but I could get a pork loin roast. I watched a video or two on how to butcher it myself and viola I was able to make my own pork chops and I can get 16-18 chops for the price of 4-6. I already had freezer paper so I just portion out how many chops I need for a meal and freeze them until I need them. I also get to control the slice thickness by doing it myself. Win, win!

I would love to know how you would keep your budget so ridiculously low if you couldn’t have: gluten grains sugar, have high histamine levels, hashimotos, and need to regularly consumer on average 6 or not cups of veggies daily!

Hi Alyssa! The answer is much longer than this little comment box will allow me, but I have readers in your same situation currently enrolled in Grocery Budget Bootcamp! I encourage you to join the waiting list, and consider enrolling when class is open again! http://grocerybudgetbootcamp.com

Leave my daughter home when I grocery shop. 🙂

Meal planning is SO helpful!! I did it religiously for about 18 months, but I fell off the wagon this spring. It was easier to get away with this lazy approach during the summer, when produce is readily available at farm stands and farmers’ markets, and I can toss anything on the grill and have a good dinner. But I’m getting back on the meal-planning wagon, now that school is about to start again, and our lives are getting busier.

Sam’s club and BJ’s are each 45-50 min away from me. I used to do BJ’s when we lived closer, but I decided to us my local stores after we moved. For me, it wasn’t worth the membership and the gas to buy in bulk. This was a very difficult decision because I LOVED buying in bulk, but…. 🙁

Anyway, I’ve tried to set a goal of $660 for my family of 8. On the months that I’ve meal planned and have been focused solely on the kitchen, I’ve been pretty good. I’ve also felt that during those times, that sometimes I’m starving my boys and daughter who are all older , 13 and up. (No, don’t eat those leftovers. They’re for another meal.) Here’s an example that I got a chuckle out of. I brought homemade turkey soup and hotdogs to church one Wed night because I was running late. We shared with whoever wanted to eat with us, and a college age kid stayed. He had 4 Styrofoam bowls of soup and a hotdog and said, “Thanks for the snack, Mrs. Reed.” 🙂 This is the mentality of my kids as well. They almost always are looking for something a couple hours later after a soup style meal.

So, I upped my budget to $800, trying to stay within $200/wk for groceries & meats incl. paper products, toiletries, etc. That’s been a better solution for us, especially in those weeks where I haven’t been super attentive to my meal plan.

One of the best things that has helped our grocery budget so far, is freezing leftovers! We eat leftovers first. If I know we are not going to eat it soon, or just plain don’t feel like having it again the next day, then I freeze it. I call these “extended leftovers”. I try to keep inventory of all the smaller portions of food, and then once we have enough “servings” of food to feed my little family, I plan it as one of our dinner nights. We might all be eating something different, but everyone is usually happy. I just pair the food with rice, or salad, or good bread, and call it a meal. Along the same lines: I also freeze almost every bit of food that doesn’t get eaten. A little bit of rice, a little bit of pasta sauce, everything. They all add up, or can possibly be added to something else. Example: A little bit of leftover frozen pasta sauce or rice could be added to a new soup that I am cooking.

There are some wonderful tips in here! Our family’s goal is to spend less than $1,000 for the month of August. I’ve warned my teens they may be getting (literal) beans & rice the last week if they keep eating so much! While that budget may sound obscenely high to some, I’m feeding 2.5 teens (all homeschooled athletic boys), plus DH & myself. Due to food allergies, we have to be careful about chemicals/preservatives and one teen is gluten sensitive.

I few additional tips that I’ve found to help:

Tuesday is clean out the fridge day. I set out whatever needs eaten and they have a “Chopped” style challenge to create a meal from the odds and ends. We rarely throw out any food.

Every meal is planned. Every single one, including snack options. We may not always follow the plan, but I have one.

Have an “oh shoot” plan. (I use a different word, but when refried beans were mentioned as an option, my boys rolled on the floor laughing.) For our house, it is nachos (with chips, beans, cheese, salsa, & veggies if we have them) or pasta w/marinara sauce (GF pasta for the one who needs it). Those ingredients are ALWAYS on hand, and those two options are never in the plan.

Kathleen, this makes me feel better. I struggle w/ our food $$$, I have seven kids at home (ages 7-22), all in school, many in sports. It’s SO expensive to keep everyone full. Your post makes me feel like I’m not way out there with my budget. I really try, I meal plan, always, and buy in bulk, etc. It’s just so much food.

I love your “oh shoot” plan Kathleen – I’d totally be okay with nachos for dinner! Your fridge clean out day on Tuesday is what we do on Saturdays, lol. I love your line, “We may not always follow the plan, but I have one.” THAT’s the mentality that makes the whole system work!

I don’t think it’s fair to compare all items equally when shopping for the same item at a different store. For example, in the pic above you show Aldi chicken at $1.69/lb vs. Publix at $3.99/lb. We just purchased the same chicken breast at Aldi and the sticker on them said “injected with 15% marinade*”. Now that * stated that the marinade was broth. God only knows what’s in that broth. I did think it was a bit odd that the sell by date was almost two weeks out and it’s not because they were sold frozen. As that old saying goes, you get what you pay for. While you have kept your budget the same since your move I do feel like the quality of the food you are buying is going down. No judging, we’ve had to do the same, just an observation.

I agree, Katie, that you get what you pay for. I would rather pay a little more and have antibiotic-free chicken, or meats in general, than try to save a dollar. God only knows what’s in the antibiotics that were injected into the animals or what else was injected into them all to make them weigh more. We usually buy our meats from a meat market that raises and butchers their own. The meat is fresher and clean with no fillers, antibiotics, or other garbage and the price is comparable to the grocery stores. The only downside is that it’s a 45-minute drive on rural mountain roads to get there. If we need to pick something up quickly, we usually go to a natural food store near home. They carry local meats that are butchered right there in the store, just like stores used to do. Recently, we pick up a package of ground beef from Wal-Mart because we didn’t want to make another stop, especially for just one pound of beef. The casserole we made with it was almost inedible. It’s amazing at how poor the quality was compared to what we usually use.

I did the same thing once, buying ground beef from Wal-Mart for the convenience. We said extra blessings that night before we ate. Lol.

Katie – the pictures are just an example, and are not necessarily meant to be an “apples to apples” comparison. The point though is to browse the circulars and find the best deal, instead of just assuming the store you always shop at or the store that’s closest has the best price.

Of course, if you’ve done your homework and know where you can get the best price all the time for the quality of items you buy, then just go there. But so many people just shop at one store for convenience and struggle with spending too much, when if they took a few minutes to look at the circular, they could have saved.

As for our quality of food, you’re right in some ways. We’re not buying organic meat all the time like we used to, we haven’t joined a CSA and I don’t have a garden. On the flip side, we’re sourcing local eggs.

It’s always a give and take. I’m giving myself grace for moving 2500 miles, then moving again, and really, I’m just now feeling like I kind of have a bearing on where I live – 7 months later. I had a great system in California, but that also took 8 years to create. Also, family priorities change over time, and sometimes that means changing the budget and/or what you buy with it.

I love your gracious answers. Diplomatic and tactful. Kudos 🙂

♥