Here are the 100+ best ways to save money. Simple, practical ideas to trim food & household, and other various expenses to save money in small easy steps!

Most people make resolutions in their lives about one of 3 things: food, health, finances (to save each month or pay off debt). Or all of the above.

It’s easy to have big, lofty goals. The hard part though, is finding ways to implement change in our daily lives to ACHIEVE the big goal.

I totally get that. When I ask new subscribers what their biggest challenge is, 80% of the time it’s related to saving money.

The biggest issue though is where to begin!

To help you kickstart your money savings, I’ve rounded up over 100 of the top money saving tips that I’ve shared over the past few years.

106 Easy Ways to Save Money

Save on Food

- Carve whole chickens into parts instead of buying pieces pre-cut (step-by-step tutorial).

- Save all the bones – from raw meat and from dinner plates – and make your own bone broth (how to do this in a slow cooker or Instant Pot).

- Buy whole roasts and stretch them over several meals (example for a whole chicken and a pork loin).

- Treat meat as a side dish, not the main dish.

- Stretch meat with whole food fillers (examples).

- Eat soup for dinner once a week (great soup recipes).

- Eat leftovers.

- Make food from scratch when it’s worth your time.

- Make food from scratch only when it saves you money and quality.

- Stop buying jelly and make fruit butter with affordable seasonal fruit (use this tutorial or make freezer jam).

- Eat out of the kitchen like you’re going on vacation every other month.

- Shop the kitchen before you leave for the grocery store.

- Save produce scraps (cores, peels and odds/ends) for smoothies or homemade stock.

- Make beans from scratch (step-by-step tutorial).

Keep an inventory of what is in the kitchen.

- Make condiments on an as-needed basis (my favorite condiment recipes).

- Cook in bulk and freeze to reduce temptations to eat out.

- Use a spatula to get the last bit out of jars and containers.

- Save bacon grease and use in lieu of butter or olive oil in cooking.

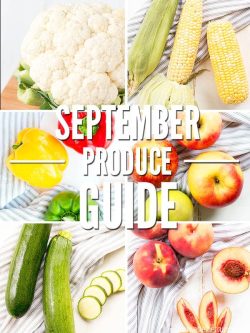

- Cook with less expensive produce (carrots, potatoes, onions) more often.

- Cook with more expensive produce (rhubarb, berries) less often.

- Make bread from scratch (our favorite recipes).

- Buttermilk from scratch (10 ways to do it).

- Make your own almond milk (recipe).

- Coconut milk (recipe).

- Make your own rice milk (recipe).

- Apple cider vinegar.

- Make your own snack crackers (recipe).

- Make your own pumpkin puree when pumpkins are cheap (tutorial).

- Buy about-to-expire milk and make yogurt (tutorial).

- Regrow food in water (tutorial).

- Make your own taco seasoning (recipe).

- Onion soup mix (recipe).

- Make your own Montreal Steak Seasoning, or Montreal Chicken Seasoning (recipe).

- Freeze tomato paste (tutorial).

- Make your own salad dressings.

- Buy whole coffee beans and grind them yourself.

- Make just enough coffee each morning (see how much you can save).

- Make your own flavored coffee (recipe).

Freeze or refrigerate leftover coffee.

- Make your own instant oatmeal (ultimate guide).

- Wrap foods well to prevent freezer burn (how to do this).

- Swap Gorgonzola instead of blue cheese (it’s cheaper).

- Swap sharp cheddar for mild cheddar (the stronger flavor means using less).

- Stop buying cereal. Make homemade granola or traditional oatmeal instead.

- Know the common cuts of meat and buy cheaper cuts.

- Keep a well stocked pantry (how to do this).

Shopping

- Create a meal plan, or buy one ready to go.

- Save butter wrappers for greasing pans.

- Weigh fixed-price, pre-bagged produce and choose the heaviest bag.

- Keep your grocery receipts.

- Create a grocery budget (here’s how).

- Grocery shop with a flexible list, substituting for what’s on sale.

- Know what’s in season.

- Price compare different stores and different markets in your area (use a price book).

- Review the circulars each week.

- Walk the entire produce section, or entire market, before deciding on a purchase.

- Shop the Clean Fifteen and the Dirty Dozen for organic purchases (find the current list here).

- Know when your stores mark down foods each week.

- Buy marked down, clearance, bruised or “seconds” produce in lieu of pretty produce.

- Purchase family-favorite items in bulk from Amazon or Thrive Market.

- Buy extra food when it’s a good deal, then freeze (tutorial) or dehydrate (tutorial) for later.

- Don’t buy a lot of an ingredient you’re trying for the first time.

- Know where you can get the best deals on items you buy on a regular basis.

- Know how to save at your favorite store (Costco, Whole Foods, Trader Joe’s, Dollar Store, Aldi, Sprouts).

- Instead of buying an ingredient, substitute what you already have (use these substitutions to start with).

- Compare in-store prices to online (Amazon or Thrive Market).

- Aim for $1 per pound for conventional produce.

- Aim for $2 per pound for organic produce.

- Create a price book (tutorial).

- Use the price book.

- Don’t go grocery shopping (our experience with 30 days without spending money).

- Whenever you bring kids with you to the store, have a plan to keep them occupied and avoid buying unplanned snacks to keep them busy.

- Compare fresh versus canned versus frozen every so often.

When you find a good deal on cheese, buy in bulk and freeze it.

- Compare prices of items in-store, like cheese in the dairy case versus cheese in the specialty section.

- Buy generic over name brand (but always read the ingredients).

- Be intentional and strategic with shopping and driving.

- Categorize your spending to see where your money is really going,

- Subscribe to a CSA (things to consider).

- Create budgets for the holidays (Thanksgiving, Christmas, Easter, Halloween).

- Maximize your holiday savings when shopping online (how to do this).

- When a pantry staple goes up in price, find ways to work around it (example using milk).

- Buy quality foods when it counts (example using olive oil).

Save on Natural Self Care

- Make your own toothpaste (recipe).

- Keep bars of soap out of water so they dry thoroughly.

- Cut bars of soap in half (more tips here).

- Make bars of soap out of soap scraps (tutorial).

- Make your own hand soap (recipe).

- Hair conditioner (tutorial).

- Make your own lip balm (recipe).

- Cut the ends off tubes like toothpaste to get the last bit out (proof of savings).

Household Ways to Save

- Stop using paper towels.

- Start using cloth napkins (how to do it).

- Start a garden, even if it’s just one item (everything for the garden).

- Switch to a cheaper cell phone plan (this is what we use for $10/month).

- Fertilize the garden using items from the kitchen (50 ways to do this).

- Use citrus vinegar for daily cleaning jobs (tutorial).

- Make your own carpet deodorizer (recipe).

- Make your own bleach alternative (recipe).

- Create a water displacement system for toilets (tutorial).

- As you wait for water to get hot, catch it and use it for cooking.

- Keep glass jars for storage (how to remove the labels).

- Turn off hot water to bathroom sinks.

- Unplug appliances and electronics when they’re not in use (proof of savings).

- Create a household budget.

I use a castile bar soap. When my bar gets too thin to use, and preferably just before it breaks, but this system works even if it does, I simply get out a new bar of soap, wet it, and place my “scrap” soap, which also is wet, on top of the new bar. Overnight it cleaves to the new bar. In this way, I never throw money away, and I don’t even have to spend time shredding, melting, reforming, and waiting for a new bar to dry.

I collect leftover veggies in a container in the freezer, adding more layers whenever I have a few veggies after a meal that aren’t enough for another meal . When I’m ready for soup, I have containers of frozen veggies to make soup that is practically free. I use a chicken carcass or leftover chicken for the base re-cooking it in water with bouillon, onions, and celery for extra flavor. Delicious!

Awesome list! I’m pretty frugal, but many of these are new to me. Happy New Year!

Track your spending (preferably for several months). It can be eye-opening to see where your money is actually going. There are free on-line programs that make this relatively easy, or use a simple spreadsheet or just pen and paper. I use an awesome program called YNAB (You Need A Budget) that takes it to the next level and helps you not only see clearly where your money is going but also gives you an easy way to plan before you spend. It has been life-changing for me and several of my children. They offer a free 34-day trial and then it is a one-time fee of $60 to continue. I would highly recommend doing the free trial and watching all their tutorials even if you choose not to buy the program. Doing the trial will help change your way of thinking about your money and help you come up with a system that works for you. (I am not affiliated with YNAB in any way, just love their program.)